1

Derivatives Rollover Report |May 28, 2021

For Private Circulation Only

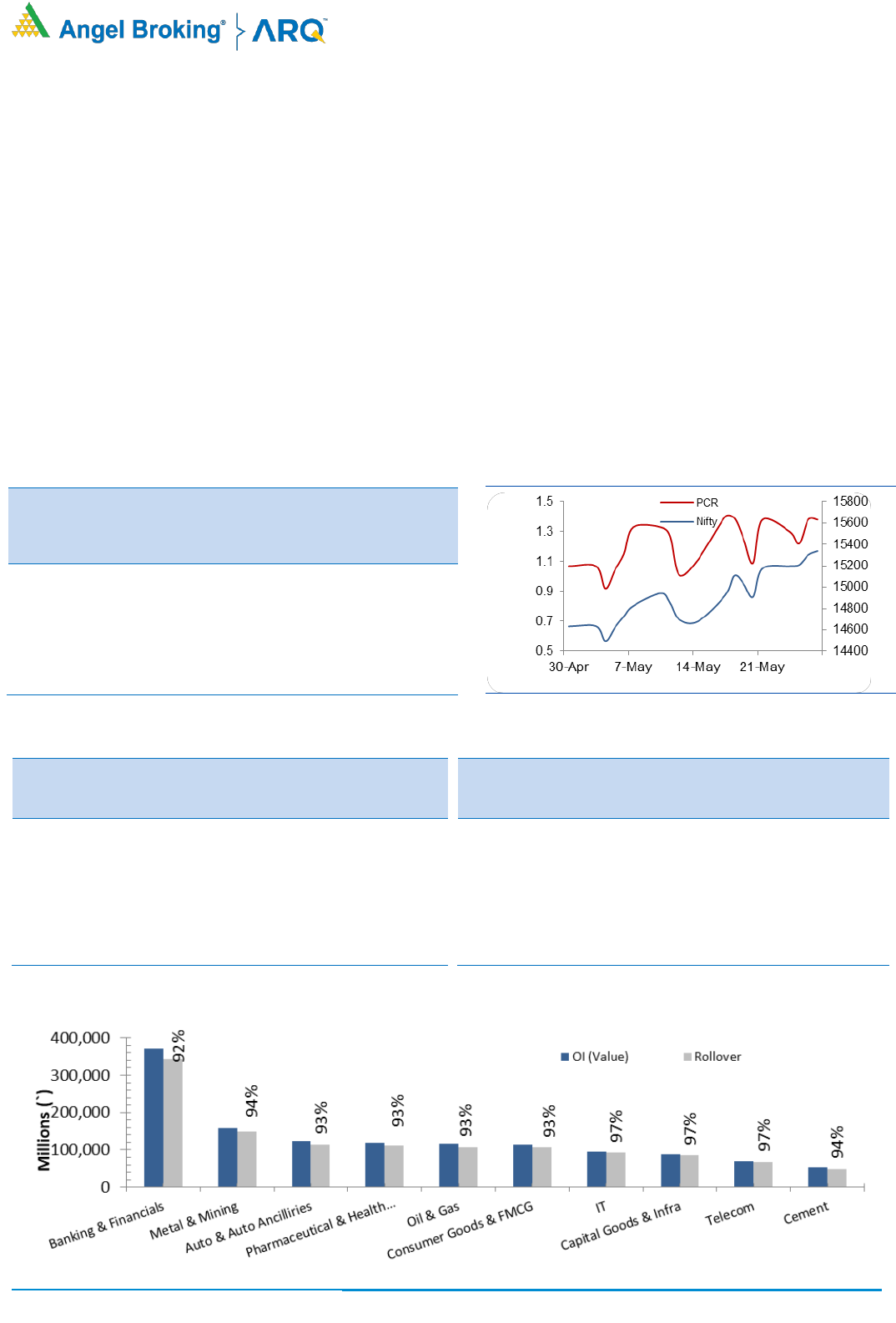

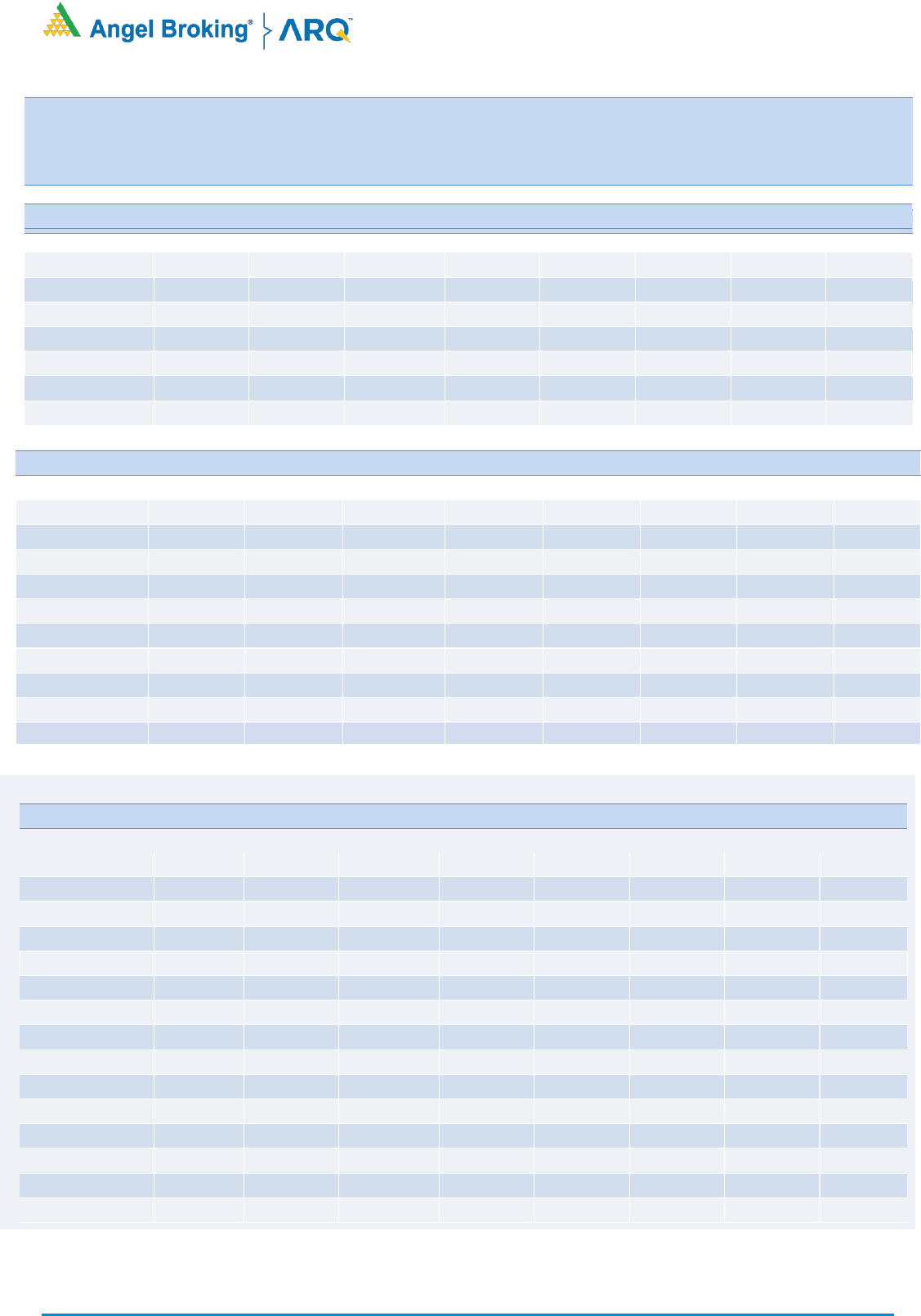

NIFTY & PCR Graph

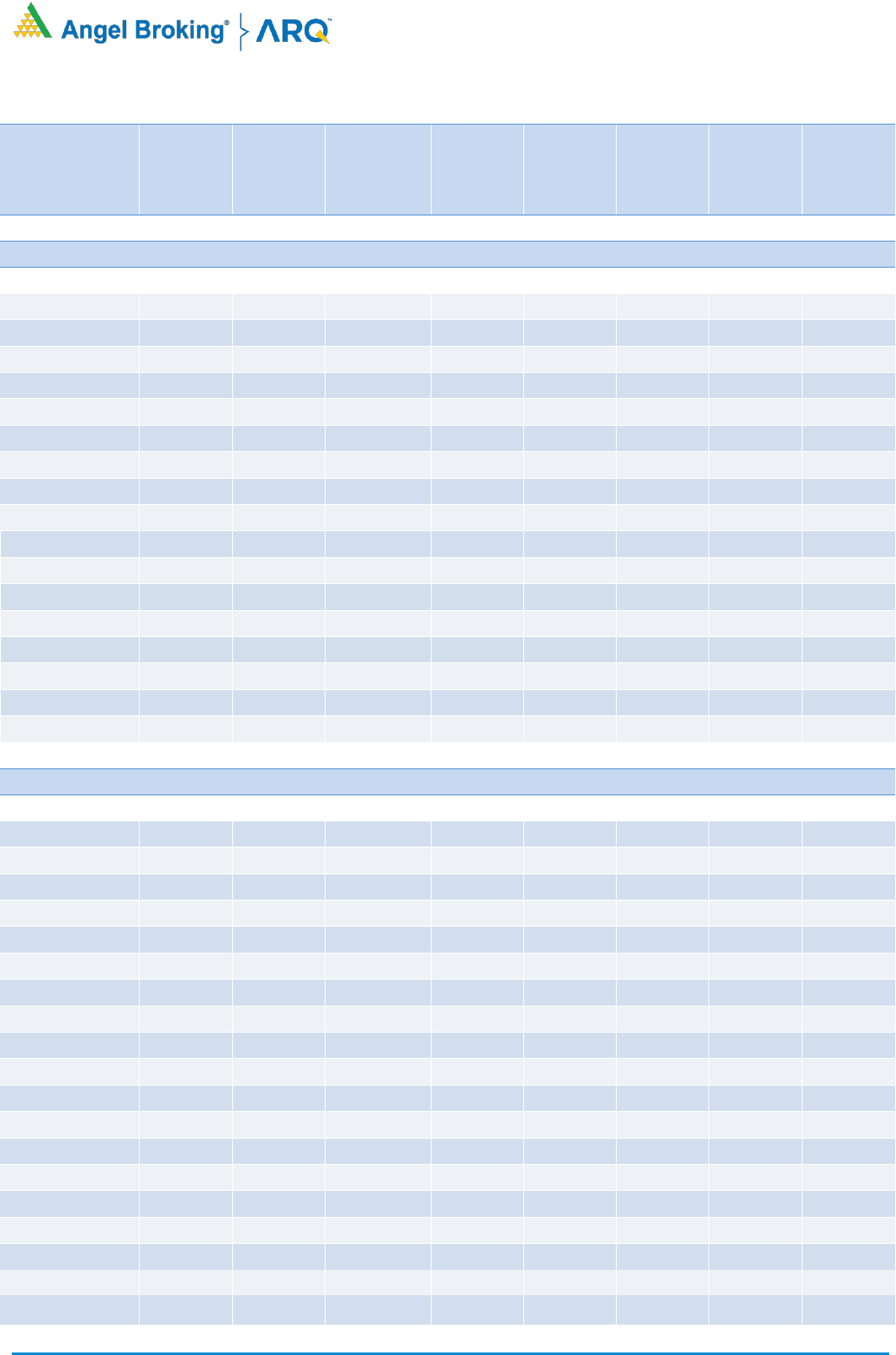

Monthly Gainers

Scrip

Price

Price

Change

(%)

Open

Interest

Ol

Change

(%)

BHEL

73.90

55.91

91402500

(4.11)

BANKBARODA

84.30

25.45

205428600

82.48

IOC

111.05

24.57

69829500

34.66

BALKRISIND

2205.45

24.40

1276000

(17.95)

COFORGE

3517.10

23.46

1131175

208.75

Note: Stocks which have more than 1000 contract in Futures OI.

Monthly Losers

Scrip

Price

Price

Change

(%)

Open

Interest

Ol

Change

(%)

JINDALSTEL

398.35

(12.81)

33255000

17.45

AUBANK

989.25

(11.76)

2613000

(9.37)

BANDHANBNK

297.20

(10.94)

21821400

39.71

TATACHEM

686.05

(10.62)

8403000

(0.63)

NAUKRI

4501.85

(10.41)

1412250

44.88

Note: Stocks which have more than 1000 contract in Futures OI.

It was yet another series wherein the Nifty maintained its positive posture. However, it wasn’t a smooth ride as we witnessed couple of

pull back moves mainly due to the nervousness seen in the global markets. Post some hiccups around 15000 mark, we finally saw a

sustainable move beyond this psychological levels in the mid of the series and then slowly extended the up move to almost touch the

15400 mark. This couldn’t have been possible without the late participation of banking index which was consolidating during the initial

two weeks of May series.

As far as F&O data is concerned, we witnessed decent longs formation during the series especially in the BankNifty. Rollover in Nifty and

BankNifty stood at 77% and 81%, respectively. These figures are above the three month averages which clearly suggest that the long

formed in May series have been rolled over. Recently, FIIs have been net buyers in equities but due to huge selling in first half of the

month they have turned net sellers of worth Rs. 9341 crores MoM. In F&O space too, they added bearish bets initially which resulted in

index futures ‘Long Short Ratio’ tanking below 50%. Fortunately, they halted selling once the global market looked stable and then

added meaningful longs along with covering of shorts. On the expiry day, they preferred carry forwarding longs and now the ‘Long Short

Ratio’ stands at 89%. Considering the above data point, we won’t be surprised to see Nifty entering the uncharted territory any time

soon. Hence, we maintain our positive stance on market and would advise trader’s to adopt buy on dips strategy until we manage to

sustain above 15000-15200 levels

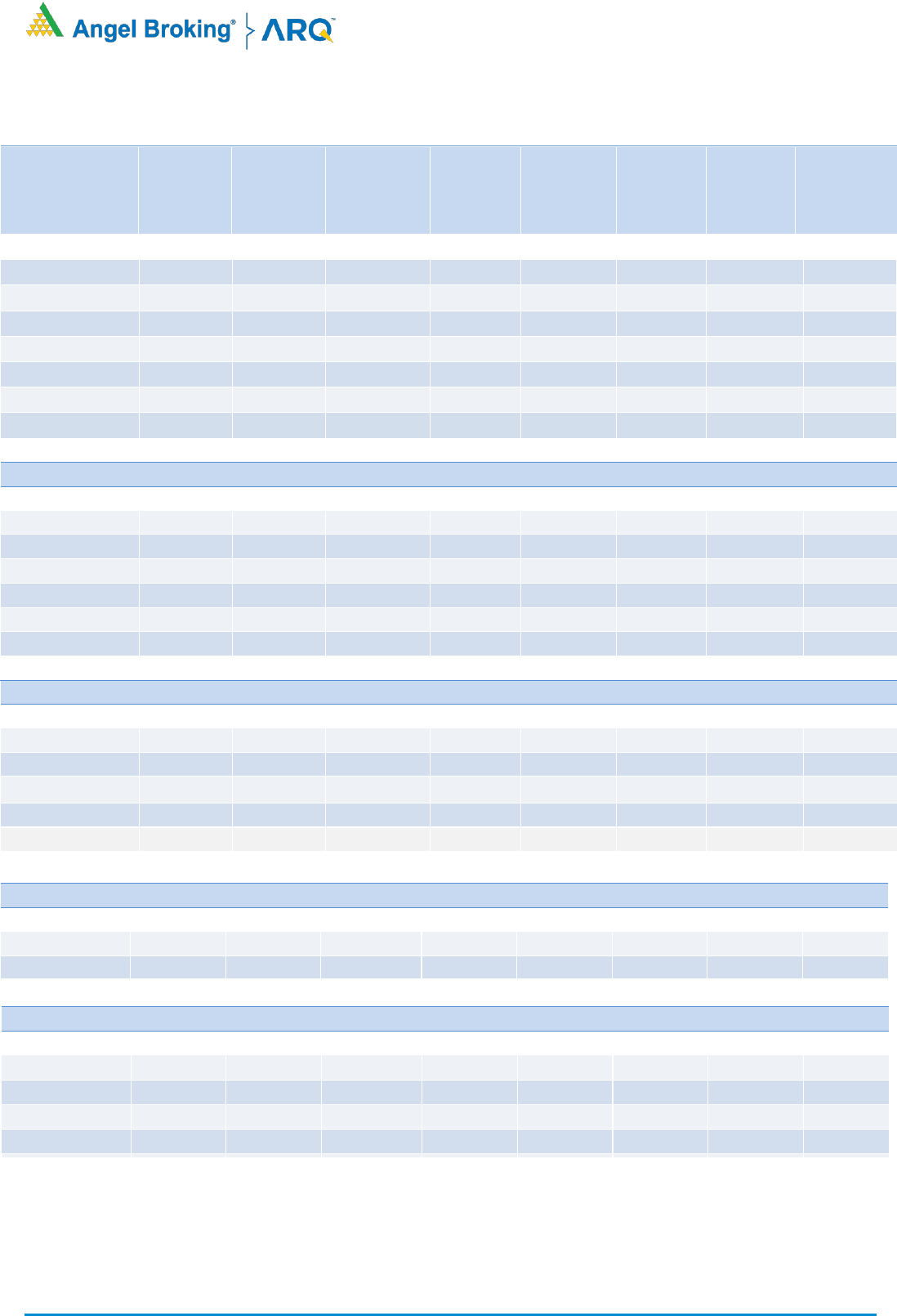

Indices Change

INDEX

Price

Price

Change

(%)

Rollover

3 month

avg.

NIFTY

14894.90

3.98

66.28

75.40

BANKNIFTY

33714.50

2.15

64.60

76.84

FINNIFTY

16047.05

3.70

48.07

44.85

-

-

-

-

-

-

-

-

-

-

Derivatives Rollover Report

For Private Circulation Only

2

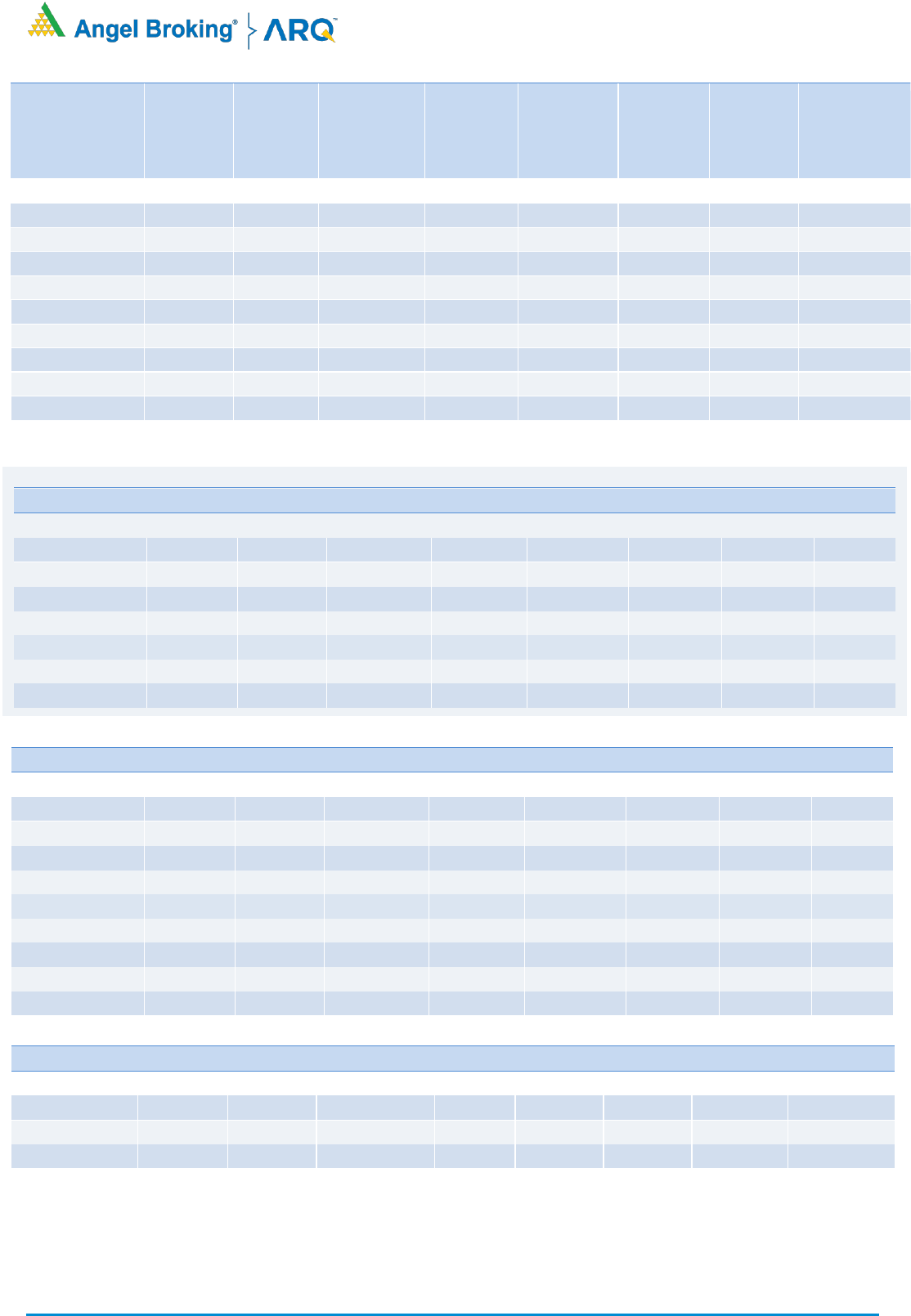

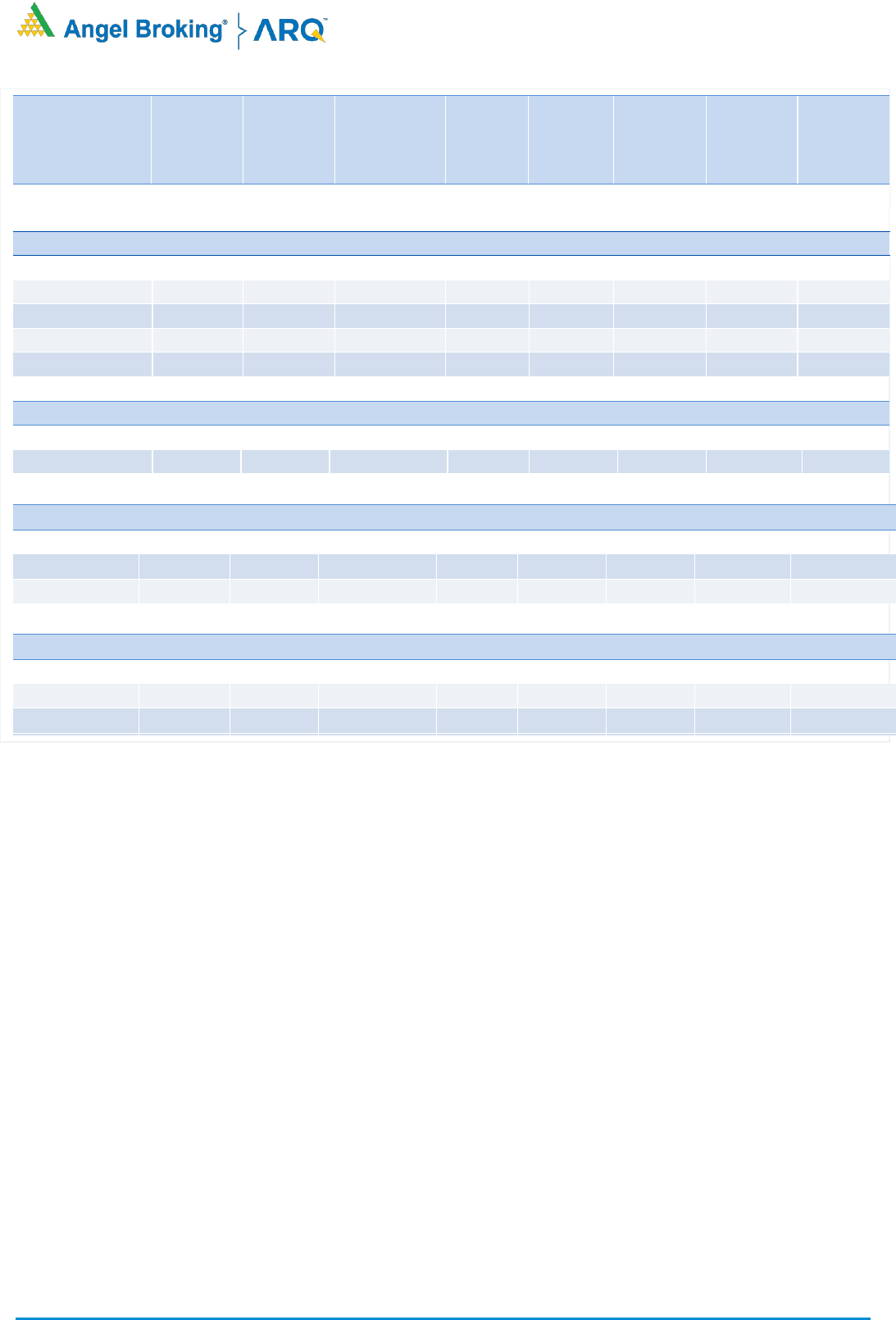

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

AUTO & AUTO ANCILLARIES

AMARAJABAT

744.40

(7.64)

8371000

112.57

13.66

0.88

91.01

94.19

APOLLOTYRE

224.60

7.52

14322500

(1.63)

9.16

0.36

87.95

90.47

ASHOKLEY

127.15

9.80

30321000

(0.12)

8.66

0.54

93.07

87.70

BAJAJ-AUTO

4258.50

10.69

1665750

(14.08)

4.26

0.30

85.97

89.68

BALKRISIND

2205.45

24.40

1276000

(17.95)

8.29

0.24

84.89

90.42

BHARATFORG

685.85

12.85

7221000

15.31

6.63

0.37

95.19

94.57

BOSCHLTD

15122.55

10.95

119900

34.64

5.29

0.42

96.69

89.25

EICHERMOT

2621.80

5.87

2815400

5.84

9.95

0.42

95.43

94.00

ESCORTS

1152.80

1.77

4235000

53.97

12.13

0.71

97.99

94.09

EXIDEIND

189.65

6.19

13968000

1.84

6.18

0.56

96.78

92.36

HEROMOTOCO

3009.35

4.79

3561300

18.33

8.79

0.53

95.53

90.37

M&M

831.45

6.77

8339100

(16.77)

5.02

0.52

86.67

86.52

MARUTI

7017.50

6.29

2116300

(16.84)

10.19

0.48

95.27

92.06

MOTHERSUMI

234.85

6.34

28140000

(0.35)

10.96

0.73

96.86

92.91

MRF

83227.85

6.75

40460

6.22

7.62

0.39

91.41

88.32

TATAMOTORS

320.55

5.60

94634250

1.42

8.94

0.53

92.97

93.52

AMARAJABAT

744.40

(7.64)

8371000

112.57

13.66

0.88

91.01

94.19

BANKING & FINANCIALS

AXISBANK

754.25

4.51

38506800

(1.93)

7.59

0.70

92.18

88.90

BAJAJFINSV

11946.30

6.43

747850

(13.71)

7.08

0.54

94.43

92.65

BAJFINANCE

5712.60

3.98

3787375

0.04

7.81

0.39

96.50

93.50

BANKBARODA

84.30

25.45

205428600

82.48

13.11

0.59

95.55

86.11

CANBK

155.45

10.80

41666400

(31.11)

17.10

0.62

85.49

92.45

CHOLAFIN

539.35

(8.77)

11063750

173.52

4.21

0.49

94.77

91.18

FEDERALBNK

88.70

13.94

66200000

13.03

10.78

0.64

93.40

93.18

HDFC

2504.05

(1.96)

17671500

23.58

-2.79

0.49

95.91

92.97

HDFCBANK

1493.00

1.44

25425400

24.24

10.24

0.65

96.27

89.81

IBULHSGFIN

218.50

19.40

24821700

6.48

-46.26

0.49

88.11

89.37

ICICIBANK

656.70

5.48

68029500

(9.69)

9.96

0.66

90.83

91.42

ICICIPRULI

531.50

0.82

6619500

(6.66)

11.49

0.36

96.61

90.73

INDUSINDBK

1012.25

7.38

15857100

(16.18)

7.83

0.93

76.59

87.71

KOTAKBANK

1789.15

(1.20)

13194400

24.16

9.78

0.64

96.00

90.95

L&TFH

89.15

(1.05)

51571796

52.28

10.72

0.62

94.72

90.28

LICHSGFIN

454.15

9.98

5534000

12.75

10.85

0.55

91.96

90.01

M&MFIN

155.80

(5.92)

41104000

142.24

12.28

0.68

96.50

89.55

MANAPPURAM

154.70

4.60

30312000

31.60

4.73

0.39

97.66

92.08

MFSL

950.10

3.14

2053350

3.44

10.84

0.34

98.78

93.63

Derivatives Rollover Report

For Private Circulation Only

3

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

MUTHOOTFIN

1250.45

6.70

2404500

(13.05)

7.39

0.83

95.70

92.19

PFC

118.15

9.60

36797000

18.96

13.09

0.66

95.82

89.79

PNB

42.55

20.71

296560000

67.72

13.86

0.71

86.82

83.74

RBLBANK

212.05

11.37

21222200

(3.49)

6.92

0.70

92.56

89.59

RECLTD

143.50

11.63

14562000

(7.75)

6.64

0.67

95.40

84.48

SBIN

423.65

17.45

100158000

7.54

-5.32

0.73

87.80

90.77

SRTRANSFIN

1441.25

1.23

2942400

(27.24)

-0.15

0.74

94.42

89.84

CAPITAL GOODS & INFRASTRUCTURE

ADANIPORTS

757.50

0.82

71881250

0.09

11.85

0.64

98.80

96.66

BHEL

73.90

55.91

91402500

(4.11)

11.95

0.72

90.43

91.20

GMRINFRA

27.00

18.42

88402500

(40.13)

10.90

0.30

94.97

88.35

HAVELLS

1021.90

0.66

3480000

(22.94)

3.01

0.39

93.69

93.43

LT

1491.15

9.15

12918525

(9.35)

8.17

0.56

95.51

93.78

SIEMENS

2058.50

8.96

823075

(9.14)

10.57

0.21

80.57

87.82

CEMENT

ACC

2014.05

6.94

2204500

(9.73)

10.11

0.53

92.94

89.65

AMBUJACEM

331.55

5.49

16581000

(10.32)

6.41

0.25

96.37

94.29

GRASIM

1427.80

5.45

13585000

(0.56)

10.97

0.40

89.86

84.60

RAMCOCEM

963.90

(2.54)

2288200

28.50

6.47

0.18

98.97

93.95

SHREECEM

28229.25

(1.32)

149125

(3.26)

8.48

0.16

90.68

91.43

CHEMICAL & FERTILIZERS

PIDILITIND

541.95

(5.51)

851000

35.73

8.05

0.33

74.71

71.65

TATACHEM

434.45

4.36

4853200

9.42

8.35

0.78

91.19

91.58

UPL

433.55

(9.37)

8288000

39.98

7.63

0.66

88.39

86.74

ASIANPAINT

738.55

3.97

5346500

1.00

14.06

0.46

84.48

81.93

COLPAL

1773.00

(6.01)

898875

4.81

12.04

0.18

86.06

85.08

DABUR

231.25

(5.80)

1755000

(51.71)

12.65

0.37

66.43

77.82

HINDUNILVR

764.40

(3.76)

5360500

5.81

9.91

0.58

83.78

75.77

ITC

376.00

3.50

30792000

13.77

12.56

0.55

83.76

72.37

JUBLFOOD

1360.60

(6.59)

2033750

4.13

-0.37

1.93

93.04

90.97

MCDOWELL-N

2368.50

(0.87)

4327875

(46.85)

6.97

0.56

76.88

71.90

MCLEODRUSS

282.55

8.38

2770000

(12.31)

4.92

0.75

76.63

89.24

TATAGLOBAL

140.95

(0.56)

18010000

(4.40)

10.35

0.56

92.05

89.07

TATAGLOBAL

149.45

(9.81)

16578000

156.63

15.89

0.33

88.97

86.06

TITAN

229.85

(14.33)

9764000

29.36

14.91

0.29

87.81

86.96

UBL

806.05

(13.71)

419500

419.50

15.46

0.00

76.59

-

CHEMICALS & FERTILIZERS

PIDILITIND

2104.30

13.13

2638500

42.93

4.77

0.87

96.12

95.17

TATACHEM

686.05

(10.62)

8403000

(0.63)

-12.03

0.55

94.62

91.79

CONCOR

556.00

(5.86)

7139784

40.51

7.43

0.32

99.05

94.03

CUMMINSIND

550.20

0.79

1871300

(0.55)

6.91

1.39

96.43

95.05

INDIGO

1441.15

(1.56)

2830800

(7.14)

6.91

0.68

96.45

88.50

JUSTDIAL

571.85

(3.36)

2202200

(17.90)

6.64

1.59

89.27

88.23

OIL & GAS

BPCL

512.45

(3.06)

26031600

34.02

6.26

0.65

98.66

93.25

GAIL

126.10

(8.19)

52849272

23.11

3.11

0.47

95.27

94.36

HINDPETRO

291.40

(10.71)

21789600

10.47

3.14

1.25

98.39

91.80

IGL

414.05

5.24

5249750

94.60

6.80

0.67

93.03

92.90

IOC

130.35

(11.05)

29414500

7.58

-21.64

0.69

75.14

76.55

MGL

1049.30

2.41

2084400

58.49

7.62

0.66

98.69

98.56

OIL

156.75

(8.71)

5095101

(42.46)

5.85

0.43

58.46

84.21

ONGC

133.25

(4.48)

26349050

38.04

0.98

0.46

82.71

71.60

Consumer Goods & FMCG

ASIANPAINT

2950.70

12.48

4509000

18.81

0.67

0.74

94.50

91.82

BERGEPAINT

801.70

11.72

4200900

43.84

6.22

0.27

95.05

93.30

BRITANNIA

3434.60

(0.52)

1886400

2.08

8.51

0.96

96.32

88.67

COLPAL

1691.60

13.54

2843050

(21.62)

5.85

0.24

97.21

95.76

CONCOR

556.00

(5.86)

7139784

40.51

7.43

0.32

99.05

94.03

CUMMINSIND

550.20

0.79

1871300

(0.55)

6.91

1.39

96.43

95.05

INDIGO

1441.15

(1.56)

2830800

(7.14)

6.91

0.68

96.45

88.50

JUSTDIAL

571.85

(3.36)

2202200

(17.90)

6.64

1.59

89.27

88.23

OIL & GAS

BPCL

512.45

(3.06)

26031600

34.02

6.26

0.65

98.66

93.25

Derivatives Rollover Report

For Private Circulation Only

4

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

DABUR

530.40

(2.36)

11246250

(1.35)

8.86

0.56

95.28

95.18

GODREJCP

838.15

19.14

4935000

23.59

11.94

0.39

93.18

88.22

97.08

HINDUNILVR

2326.95

(3.93)

6909000

0.30

0.35

0.95

96.50

91.32

98.06

ITC

210.40

2.86

147283200

49.95

-5.19

0.55

89.34

86.99

96.24

JUBLFOOD

3117.30

5.61

1252250

(2.78)

9.90

0.31

96.87

92.50

97.07

MARICO

475.60

15.35

7902000

9.81

7.56

0.35

95.48

94.90

96.04

MCDOWELL-N

606.20

14.76

11272500

(14.83)

9.70

0.51

91.57

94.25

NESTLEIND

17827.20

7.40

235450

(21.58)

6.61

0.59

92.55

89.01

95.18

TATACONSUM

647.50

(3.95)

6732450

1.59

-2.36

0.62

96.44

75.96

97.08

DABUR

530.40

(2.36)

11246250

(1.35)

8.86

0.56

95.28

95.18

98.06

GODREJCP

838.15

19.14

4935000

23.59

11.94

0.39

93.18

88.22

96.24

MEDIA

DISHTV

13.35

(11.88)

95013000

(6.31)

14.81

0.46

93.85

92.83

PVR

1828.55

1.92

865200

(20.59)

5.15

0.62

91.34

88.69

SUNTV

448.35

(8.42)

3636000

30.53

9.22

1.64

92.03

90.57

ZEEL

298.80

(4.38)

27648800

(9.61)

6.58

0.84

91.85

83.77

COALINDIA

293.80

1.71

14714400

2

9

.

8

0

8.26

0.35

63.04

65.79

HINDALCO

88.10

30.23

34330000

(

1

3

.

3

6

)

2.22

0.61

78.46

82.59

HINDZINC

182.40

10.61

3964800

1

0

8

.

5

9

-8.52

0.34

71.17

74.01

JINDALSTEL

60.45

11.12

32228000

(

9

.

0

1

)

4.33

0.32

80.34

78.99

JSWSTEEL

(

1

9

.

0

METALS & MINING

COALINDIA

145.35

12.98

49035000

38.44

8.08

0.50

92.44

84.66

HINDALCO

387.95

3.61

27365200

(21.48)

7.95

0.61

93.53

89.78

JINDALSTEL

398.35

(12.81)

33255000

17.45

12.94

0.55

94.65

92.15

JSWSTEEL

687.15

(5.78)

34418250

2.48

11.35

0.95

91.13

91.72

NATIONALUM

74.40

14.29

81855000

(4.14)

11.87

0.77

95.80

94.12

NMDC

179.90

16.06

59911400

35.22

11.04

0.65

91.52

84.66

SAIL

123.30

8.87

153026000

48.82

12.54

0.62

90.49

86.21

TATASTEEL

1081.30

4.24

44104800

(8.94)

-20.44

0.59

96.23

93.05

VEDL

269.85

5.16

124660300

84.89

11.73

0.64

95.89

74.74

Media

PVR

1293.00

9.54

1435489

(14.46)

5.38

0.78

86.74

82.27

SUNTV

545.15

4.29

13707000

0.65

8.76

0.43

98.92

96.33

ZEEL

211.85

12.99

87225000

36.76

14.62

0.70

98.17

96.73

TEXTILES

ARVIND

66.40

(15.36)

5862000

(11.53)

5.92

1.09

82.52

89.16

CENTURYTEX

959.75

(7.62)

3744000

5.98

-1.70

0.81

98.89

99.06

PAGEIND

20491.75

6.10

156325

9.82

-9.51

0

96.19

89.39

RAYMOND

739.95

(13.35)

2732800

4.75

7.00

1.38

97.21

96.63

SRF

3044.00

4.24

923500

9.81

8.82

0.56

95.08

96.97

INFORMATION TECHNOLOGY

HCLTECH

948.00

3.62

21199500

(2.97)

8.68

0.73

97.33

94.44

INFY

1397.50

2.70

30925200

10.59

-4.95

0.65

97.48

92.64

MINDTREE

2320.85

10.16

1824800

27.08

6.70

0.35

96.02

84.05

COFORGE

3517.10

23.46

1131175

208.75

8.87

0.17

84.41

80.14

TCS

3204.35

2.42

6739200

16.39

11.18

0.72

97.15

90.42

TECHM

1026.90

4.68

10338600

(1.50)

10.16

0.81

96.36

93.50

WIPRO

540.60

10.08

34116800

20.21

-0.81

0.70

96.84

87.62

TELECOM

BHARTIARTL

350.55

0.39

34602594

(4.18)

7.10

0.90

89.38

87.82

IDEA

12.45

(7.43)

363300000

(10.52)

10.56

0.83

82.76

85.28

INFRATEL

276.95

1.58

6836000

3.14

10.20

0.49

84.58

83.89

TEXTILES

ARVIND

66.40

(15.36)

5862000

(11.53)

5.92

1.09

82.52

89.16

CENTURYTEX

959.75

(7.62)

3744000

5.98

-1.70

0.81

98.89

99.06

PAGEIND

20491.75

6.10

156325

9.82

-9.51

0

96.19

89.39

RAYMOND

739.95

(13.35)

2732800

4.75

7.00

1.38

97.21

96.63

SRF

3044.00

4.24

923500

9.81

8.82

0.56

95.08

96.97

MEDIA

DISHTV

31.30

(14.36)

79358000

36.60

10.50

0.80

90.60

90.38

PVR

1761.85

2.35

686000

(1.21)

-9.55

0.77

94.75

94.46

SUNTV

549.00

(5.52)

6148000

(0.26)

8.72

0.63

92.24

91.73

TV18BRDCST

29.25

(12.56)

44369000

(32.71)

2.23

0.44

94.15

94.99

ZEEL

367.90

(12.44)

20372300

18.63

9.46

0.47

97.35

90.61

Derivatives Rollover Report

For Private Circulation Only

5

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

INFORMATION TECHNOLOGY

HCLTECH

564.00

(0.70)

22885800

(1.26)

8.14

0.58

98.56

96.78

INFY

730.55

3.77

24351600

(52.50)

2.86

0.74

55.98

79.52

MINDTREE

782.95

10.93

1041600

(14.29)

-15.63

0.59

93.13

93.37

NIITTECH

1606.65

6.68

578250

26.08

-2.03

0.46

89.76

82.99

TCS

2212.80

6.19

15671500

(17.22)

6.42

1.91

95.02

94.74

TECHM

775.75

1.00

15406800

8.21

9.05

0.65

96.29

97.15

WIPRO

249.90

3.65

18211200

(29.64)

-2.08

0.72

83.12

92.60

MISCELLANIOUS

ADANIENT

1329.35

11.75

18984000

31.74

3.91

1.02

93.49

88.22

APOLLOHOSP

3211.20

(1.22)

1746750

(5.07)

5.59

0.80

91.68

90.21

BATAINDIA

1558.55

14.93

850300

(32.13)

11.85

0.31

83.93

86.95

BEL

149.00

14.09

38634600

27.57

4.42

0.46

96.31

89.50

CONCOR

671.10

19.66

7780614

42.19

7.43

0.40

93.41

91.32

CUMMINSIND

778.00

(9.69)

2682600

153.75

11.82

0.54

96.50

89.37

INDIGO

1741.65

5.71

3449000

(6.26)

0.80

0.25

89.35

87.40

OIL & GAS

BPCL

470.70

11.69

44681400

8.98

8.89

0.51

93.84

91.32

GAIL

153.80

13.67

31988400

5.05

9.55

0.53

77.44

71.10

HINDPETRO

282.45

22.27

25501500

17.69

10.67

0.78

90.56

90.46

IGL

520.95

2.52

6111875

54.39

10.44

0.71

96.93

91.10

IOC

111.05

24.57

69829500

34.66

10.59

0.53

91.34

88.78

MGL

1215.15

10.04

1613400

19.62

5.31

0.45

97.18

94.35

ONGC

112.65

7.70

45345300

39.22

10.44

0.35

89.89

87.44

PETRONET

241.10

1.97

16596000

2.98

9.75

0.54

98.57

94.45

RELIANCE

1984.85

(2.19)

28872500

7.68

6.46

0.44

93.87

93.81

BPCL

470.70

11.69

44681400

8.98

8.89

0.51

93.84

91.32

BATAINDIA

1444.10

8.68

1488850

(10.54)

-2.88

0.42

93.06

94.61

BEL

115.85

1.49

22602000

(2.49)

10.21

0.44

97.34

96.42

MCX

659.60

(6.88)

2102100

(7.23)

11.16

0.79

93.26

90.88

MCX

1111.60

2.65

1348000

12.33

-3.27

0.66

92.87

80.54

PHARMACEUTICAL

AUROPHARMA

1037.15

6.60

8765250

(5.00)

7.85

0.51

97.81

95.86

BIOCON

383.45

(3.23)

17434000

0.03

5.93

0.71

86.18

89.52

CADILAHC

629.55

11.44

22301400

43.30

6.29

0.51

95.72

93.45

CIPLA

946.80

3.82

10505950

(19.23)

6.89

0.53

91.10

89.74

DIVISLAB

4112.60

4.73

2335400

(0.49)

11.94

0.71

91.35

92.40

DRREDDY

5299.45

3.34

2666250

(12.33)

8.48

1.16

90.40

91.56

GLENMARK

611.45

7.33

8406500

11.13

11.67

0.54

94.07

89.81

LUPIN

1209.10

14.22

7215650

(14.70)

6.98

0.66

87.26

88.15

PEL

1816.60

7.07

3435300

1.18

6.62

0.42

96.40

95.29

SUNPHARMA

703.65

8.63

45837400

15.91

8.66

0.57

95.43

95.62

TORNTPHARM

2716.20

8.30

824750

(16.12)

-1.64

0.38

93.64

94.01

AUROPHARMA

1037.15

6.60

8765250

(5.00)

7.85

0.51

97.81

95.86

BIOCON

383.45

(3.23)

17434000

0.03

5.93

0.71

86.18

89.52

CADILAHC

629.55

11.44

22301400

43.30

6.29

0.51

95.72

93.45

CIPLA

946.80

3.82

10505950

(19.23)

6.89

0.53

91.10

89.74

OIL & GAS

BPCL

512.45

(3.06)

26031600

34.02

6.26

0.65

98.66

93.25

GAIL

126.10

(8.19)

52849272

23.11

3.11

0.47

95.27

94.36

HINDPETRO

291.40

(10.71)

21789600

10.47

3.14

1.25

98.39

91.80

Derivatives Rollover Report

For Private Circulation Only

6

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

POWER

NTPC

110.95

7.15

64940100

(4.39)

8.60

0.44

82.26

86.75

POWERGRID

229.05

3.74

16448000

(13.23)

4.80

0.57

87.41

73.60

TATAPOWER

105.40

7.22

133157250

11.13

-13.04

0.47

97.48

95.72

TORNTPOWER

427.10

7.60

2008500

4.12

-9.51

0.30

91.59

90.29

REAL ESTATE

DLF

285.15

14.04

29102700

(1.38)

9.02

0.53

96.12

93.78

TELECOM

BHARTIARTL

523.90

(3.51)

115041501

23.00

11.52

0.73

97.97

95.78

IDEA

8.50

0.59

582960000

(6.28)

8.64

0.46

85.39

73.89

TEXTILES

PAGEIND

32025.90

6.54

93510

44.17

11.96

0.28

98.51

95.74

SRF

6544.35

1.24

338625

(19.35)

10.10

0.39

95.45

92.34

CENTURYTEX

487.95

4.96

3472200

3.19

9.28

0.26

98.91

84.95

PAGEIND

22340.05

0.42

115325

(20.02)

3.23

0.00

90.77

89.33

POWER

ADANIPOWER

51.75

(0.38)

131920000

(3.16)

6.33

0.68

98.37

95.34

CESC

788.45

5.04

1217600

(14.52)

10.16

0.05

96.98

94.18

NTPC

140.85

3.57

63643200

46.15

6.51

0.42

74.18

71.71

POWERGRID

208.95

8.77

31196000

46.96

7.85

0.98

86.83

81.73

TATAPOWER

69.25

(0.22)

53307000

(2.47)

11.39

0.95

92.66

92.57

TORNTPOWER

280.50

13.36

4017000

90.20

-26.19

1.31

84.48

88.46

Derivatives Rollover Report

For Private Circulation Only

7

Technical and Derivatives Team:

Sameet Chavan Chief Analyst - Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Research Team Tel: 022 - 39357600 (EXTN - 6844) Website: www.angelbroking.com

For Technical & Derivative Queries E-mail: technicalresearch-cso@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor.

Angel Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014

vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the

securities of the companies referred to in this document (including the merits and risks involved), and should consult their own

advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions

and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a

company's fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website

to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Derivative Research Team derivatives.desk@angelbroking.com